All Categories

Featured

Table of Contents

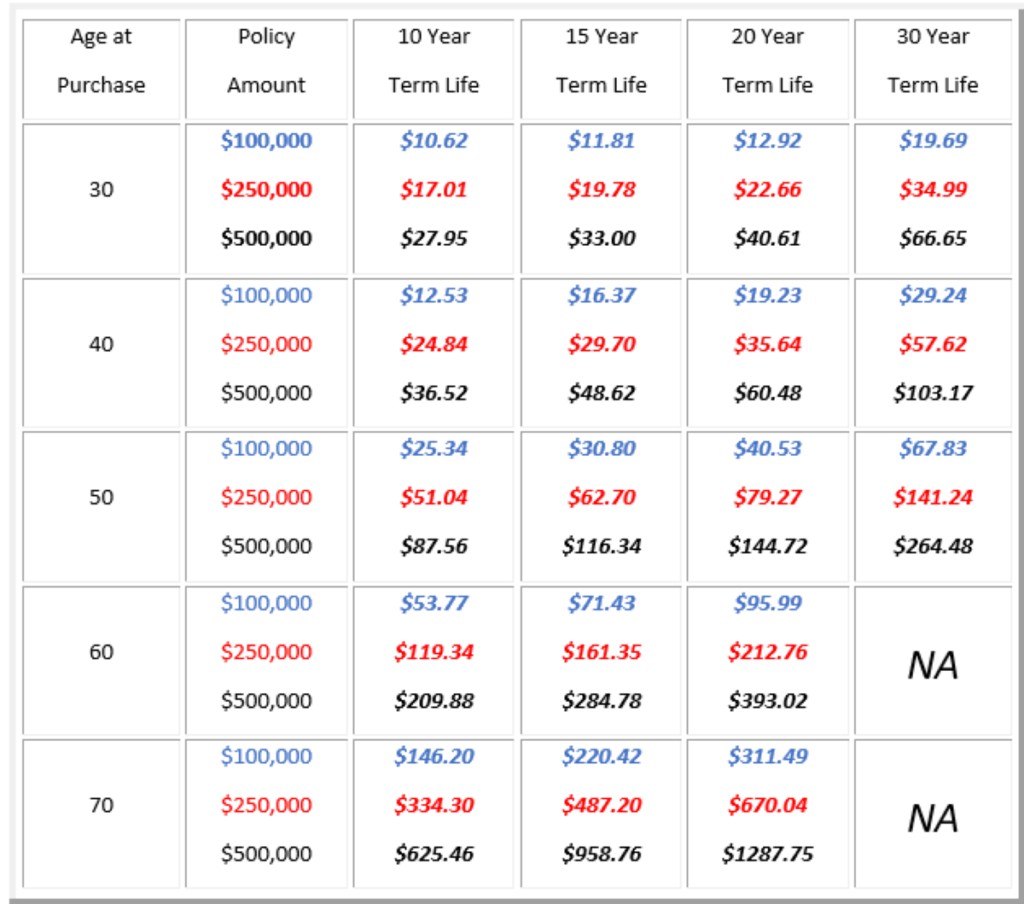

A level term life insurance coverage plan can provide you tranquility of mind that the people that rely on you will certainly have a survivor benefit during the years that you are planning to sustain them. It's a means to aid take treatment of them in the future, today. A degree term life insurance policy (occasionally called level premium term life insurance) plan supplies insurance coverage for an established number of years (e.g., 10 or twenty years) while maintaining the costs settlements the exact same throughout of the policy.

With degree term insurance, the expense of the insurance policy will certainly remain the very same (or potentially lower if rewards are paid) over the regard to your plan, typically 10 or twenty years. Unlike permanent life insurance policy, which never ever ends as lengthy as you pay premiums, a degree term life insurance coverage plan will certainly finish at some time in the future, commonly at the end of the period of your level term.

What Is Level Benefit Term Life Insurance? A Complete Guide

Because of this, many individuals make use of long-term insurance as a steady economic preparation device that can offer many needs. You might be able to transform some, or all, of your term insurance policy during a set period, normally the very first ten years of your plan, without requiring to re-qualify for coverage even if your wellness has transformed.

As it does, you may intend to add to your insurance policy coverage in the future. When you first obtain insurance policy, you might have little cost savings and a huge home mortgage. At some point, your financial savings will grow and your home mortgage will certainly diminish. As this happens, you may intend to eventually decrease your death advantage or consider transforming your term insurance to a long-term plan.

So long as you pay your costs, you can rest easy knowing that your loved ones will certainly obtain a survivor benefit if you pass away during the term. Lots of term plans enable you the capacity to transform to long-term insurance policy without having to take one more health and wellness exam. This can allow you to make the most of the fringe benefits of a permanent plan.

Level term life insurance coverage is among the easiest courses into life insurance policy, we'll review the advantages and disadvantages to make sure that you can choose a strategy to fit your demands. Level term life insurance policy is the most common and standard kind of term life. When you're searching for short-lived life insurance policy plans, degree term life insurance policy is one route that you can go.

The application process for degree term life insurance is usually extremely straightforward. You'll fill up out an application that includes basic individual info such as your name, age, etc as well as an extra detailed questionnaire regarding your clinical background. Relying on the plan you have an interest in, you may have to take part in a medical checkup process.

The brief solution is no. A degree term life insurance policy policy doesn't build money value. If you're aiming to have a policy that you have the ability to withdraw or borrow from, you may explore irreversible life insurance policy. Whole life insurance policy policies, as an example, allow you have the convenience of fatality advantages and can accumulate money worth with time, indicating you'll have extra control over your advantages while you're to life.

What is What Is Direct Term Life Insurance? An Essential Overview?

Bikers are optional arrangements included in your policy that can offer you extra advantages and defenses. Cyclists are a fantastic means to include safeguards to your policy. Anything can happen throughout your life insurance policy term, and you intend to await anything. By paying just a bit much more a month, motorcyclists can offer the assistance you require in situation of an emergency situation.

There are circumstances where these benefits are constructed right into your plan, however they can also be offered as a separate enhancement that calls for additional payment.

Latest Posts

Mutual Of Omaha Burial Insurance Rates

Burial Insurance For Seniors Over 80

Final Expense Life Insurance Carriers