All Categories

Featured

Table of Contents

Mortgage life insurance provides near-universal coverage with very little underwriting. There is frequently no medical evaluation or blood sample required and can be a useful insurance coverage plan alternative for any type of house owner with major preexisting clinical conditions which, would certainly avoid them from getting standard life insurance policy. Other advantages consist of: With a home mortgage life insurance coverage policy in location, successors will not have to worry or wonder what may happen to the household home.

With the mortgage paid off, the family will constantly have an area to live, given they can afford the residential property tax obligations and insurance policy annually. how much does mortgage protection cost.

There are a few various sorts of mortgage defense insurance policy, these include:: as you pay more off your mortgage, the amount that the policy covers minimizes according to the impressive balance of your mortgage. It is one of the most common and the most inexpensive type of home mortgage protection - mortgage life.: the amount insured and the costs you pay continues to be degree

This will pay off the mortgage and any kind of continuing to be balance will most likely to your estate.: if you want to, you can include significant illness cover to your home loan defense plan. This suggests your home mortgage will certainly be cleared not only if you pass away, but also if you are identified with a serious disease that is covered by your policy.

Mortgage Protection Insurance Claim

In addition, if there is a balance remaining after the home mortgage is removed, this will go to your estate. If you alter your home mortgage, there are several points to take into consideration, relying on whether you are topping up or extending your home loan, switching, or paying the home loan off early. If you are covering up your home mortgage, you need to make certain that your plan meets the brand-new worth of your home loan.

Compare the prices and advantages of both options (compare payment protection insurance). It might be cheaper to maintain your initial home mortgage protection plan and afterwards purchase a second policy for the top-up amount. Whether you are covering up your home loan or extending the term and need to obtain a new plan, you may locate that your costs is higher than the last time you got cover

Mortgage Insurance Company

When switching your home mortgage, you can appoint your mortgage protection to the brand-new loan provider. The costs and degree of cover will certainly coincide as prior to if the quantity you obtain, and the regard to your home loan does not transform. If you have a plan with your lender's group system, your lending institution will certainly cancel the policy when you change your home loan.

There won't be an emergency where a big expense schedules and no way to pay it so quickly after the death of a liked one. You're supplying assurance for your household! In The golden state, mortgage security insurance covers the entire superior balance of your financing. The death advantage is an amount equal to the balance of your home mortgage at the time of your death.

Mortgage Insurance Unemployed

It's crucial to recognize that the survivor benefit is given directly to your lender, not your loved ones. This guarantees that the continuing to be financial obligation is paid in complete and that your liked ones are spared the economic strain. Mortgage protection insurance can likewise offer temporary coverage if you come to be handicapped for a prolonged period (normally 6 months to a year).

There are numerous advantages to obtaining a home mortgage protection insurance plan in California. A few of the top advantages include: Assured approval: Also if you're in inadequate wellness or work in an unsafe occupation, there is assured authorization without any medical examinations or laboratory tests. The exact same isn't real permanently insurance.

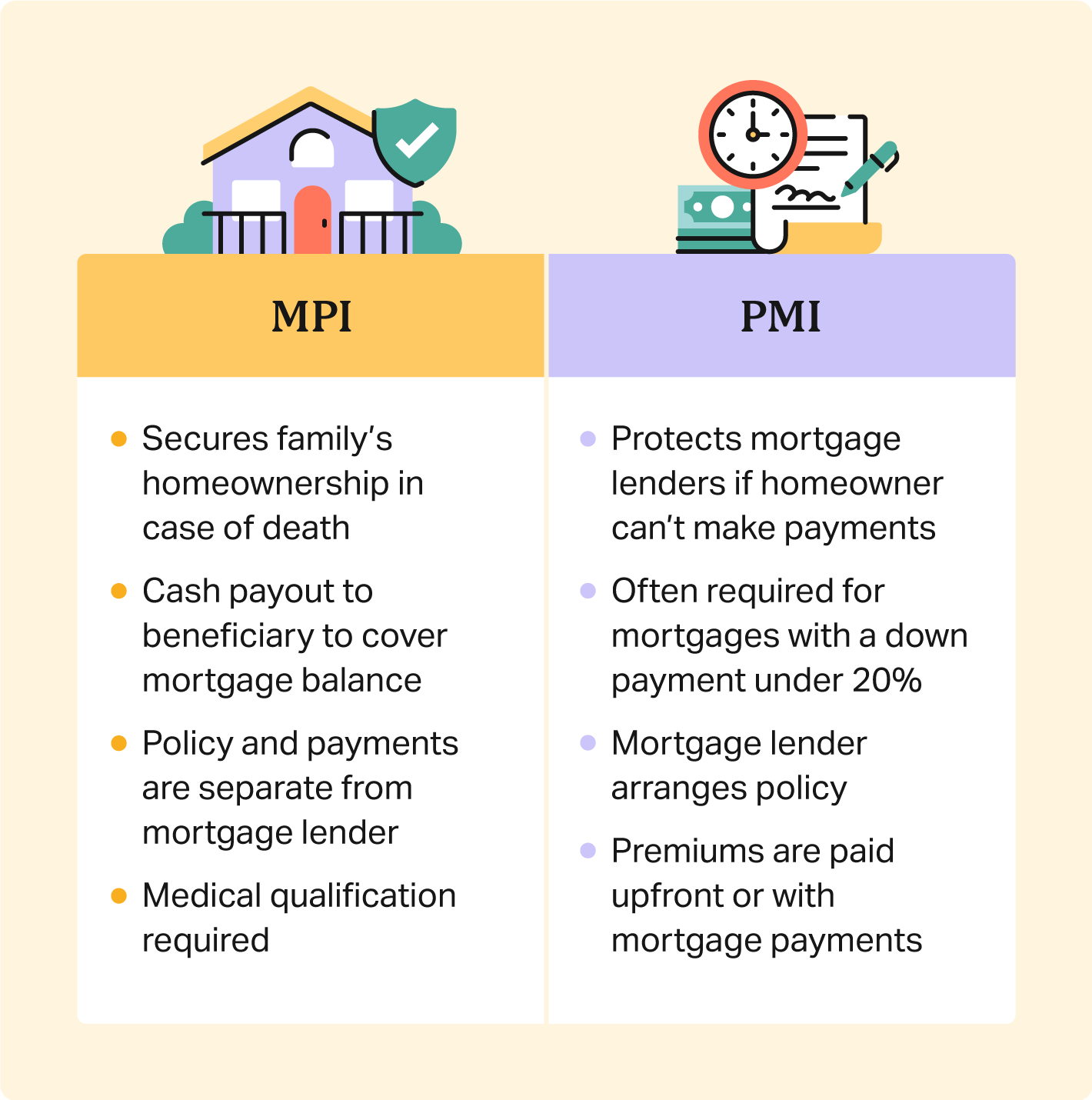

Impairment defense: As stated over, some MPI plans make a few mortgage repayments if you end up being disabled and can not bring in the very same revenue you were accustomed to. It is necessary to note that MPI, PMI, and MIP are all various types of insurance policy. Home mortgage defense insurance (MPI) is created to repay a home mortgage in instance of your fatality.

Job Loss Mortgage Payment Protection

You can even apply online in mins and have your plan in position within the same day. For additional information regarding obtaining MPI insurance coverage for your home loan, call Pronto Insurance today! Our experienced representatives are below to address any type of questions you might have and provide more assistance.

MPI provides a number of advantages, such as peace of mind and simplified certification procedures. The fatality advantage is directly paid to the lending institution, which limits versatility - life insurance for mortgage protection. Furthermore, the advantage quantity decreases over time, and MPI can be more pricey than standard term life insurance coverage plans.

Mortgage Home Insurance

Go into fundamental information regarding yourself and your mortgage, and we'll contrast prices from different insurers. We'll also reveal you how much protection you need to secure your home mortgage. Obtain started today and give yourself and your family the peace of mind that comes with understanding you're shielded. At The Annuity Specialist, we recognize home owners' core issue: guaranteeing their household can keep their home in the event of their death.

The primary advantage here is clearness and self-confidence in your choice, knowing you have a plan that fits your requirements. When you authorize the strategy, we'll take care of all the paperwork and configuration, making sure a smooth implementation process. The positive result is the peace of mind that features understanding your household is safeguarded and your home is protected, whatever occurs.

Specialist Advice: Support from experienced specialists in insurance coverage and annuities. Hassle-Free Setup: We handle all the paperwork and application. Affordable Solutions: Locating the best insurance coverage at the lowest feasible cost.: MPI specifically covers your home mortgage, offering an added layer of protection.: We function to locate the most cost-effective remedies tailored to your budget plan.

They can give information on the coverage and advantages that you have. Usually, a healthy individual can expect to pay around $50 to $100 monthly for mortgage life insurance. Nevertheless, it's recommended to get a customized home mortgage life insurance quote to get an exact price quote based upon specific conditions.

Latest Posts

Mutual Of Omaha Burial Insurance Rates

Burial Insurance For Seniors Over 80

Final Expense Life Insurance Carriers